Running a household can feel like managing a small business. There are multiple income streams, bills to pay, unexpected costs, and long-term goals like saving for holidays, education, or retirement. Without proper planning, money often slips through the cracks.

This is where a household budget calculator becomes invaluable. It’s a practical tool that helps families keep track of income and expenses, align spending with priorities, and ultimately achieve financial peace of mind.

In this article, we’ll explore why personal finance matters for families, how a household budget calculator works, and practical steps to make it part of your financial routine.

Why Personal Finance Is Crucial for Families

Personal finance refers to how individuals or families manage money—budgeting, saving, investing, and planning for future needs. For families, it’s even more critical because there are more responsibilities and often higher expenses.

Good personal finance practices allow families to:

- Cover essential bills without stress.

- Save for short-term needs (holidays, school costs).

- Plan for long-term goals (buying a home, retirement).

- Handle emergencies without debt.

- Teach children healthy money habits.

Without a budget, families risk living paycheck to paycheck, overspending, or struggling with unexpected bills. With a household budget calculator, these challenges become manageable.

What Is a Household Budget Calculator?

A household budget calculator is a digital tool designed to simplify family money management.

Here’s what it does:

- Tracks family income: Salaries, side hustles, benefits, rental income.

- Organises expenses: Housing, utilities, food, transport, childcare, entertainment.

- Shows cash flow: Highlights if your spending exceeds income.

- Supports decision-making: Helps you cut wasteful costs and allocate funds wisely.

- Encourages savings: Calculates how much you can set aside each month.

Think of it as your financial control panel. Instead of guessing where the money goes, the calculator shows a clear picture—so every pound has a purpose.

How Families Can Benefit from a Household Budget Calculator

1. Transparency

No more wondering where the money went. The calculator gives everyone in the household a clear view of spending patterns.

2. Better Planning

It helps plan for both essentials and extras, like school trips, family holidays, or birthdays.

3. Reduced Stress

Money fights are a leading cause of family stress. A clear budget promotes open communication and teamwork.

4. Financial Security

With regular tracking, families can build an emergency fund, pay off debts faster, and save for the future.

5. Smart Habits for Kids

When parents budget, children learn valuable personal finance lessons by example.

How to Use a Household Budget Calculator: Step-by-Step

Here’s a simple process any family can follow:

Step 1: Collect All Income Sources

- Primary salary

- Second job or side hustle

- Child benefits

- Any other recurring income

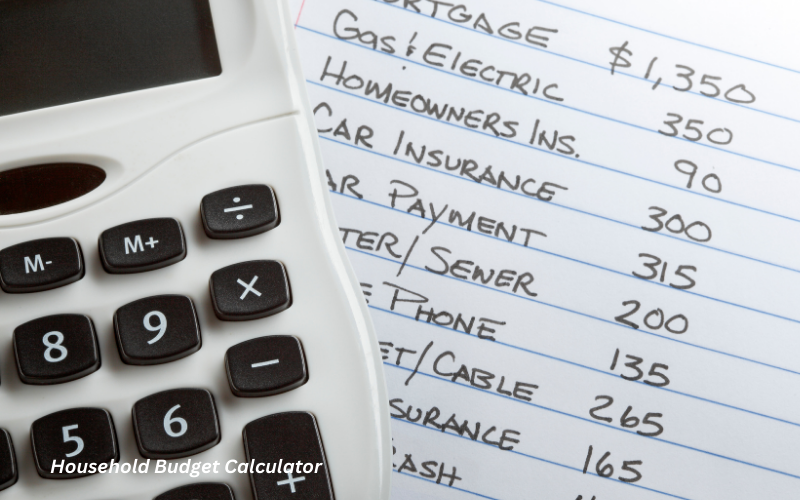

Step 2: List Household Expenses

Break it into categories:

- Housing: Rent/mortgage, council tax, utilities.

- Food: Groceries, takeaways, school meals.

- Transport: Fuel, public transport, insurance.

- Children: Childcare, school fees, activities.

- Health & Insurance: Medical, dental, life insurance.

- Lifestyle: Entertainment, subscriptions, dining out.

Step 3: Enter Debts & Loans

Credit card repayments, car loans, student loans.

Step 4: Add Savings Goals

Emergency fund, retirement savings, education fund, travel.

Step 5: Review the Results

The calculator will display:

- Total income

- Total expenses

- Net result (surplus or deficit)

Step 6: Make Adjustments

- If surplus: Increase savings or debt repayment.

- If deficit: Cut unnecessary spending or seek extra income.

💡 Try our free Household Budget Calculator to start simplifying your family finances today.

Popular Budgeting Methods for Families

Not all households budget the same way. Here are some proven strategies:

1. The 50/30/20 Rule

- 50% needs

- 30% wants

- 20% savings/debt repayment

Great for families who want a simple starting framework.

2. Zero-Based Budgeting

Every pound is assigned a task—nothing is left unplanned. Ideal for households wanting strict control.

3. Envelope Method (Digital or Cash)

Money is divided into “envelopes” (categories). When one envelope is empty, you stop spending in that category.

A household budget calculator makes applying these methods easier and more precise.

Common Mistakes Families Make in Budgeting

Avoid these traps to make your budget effective:

- Forgetting irregular expenses: Holidays, car repairs, birthdays.

- Underestimating lifestyle costs: Subscriptions, streaming, takeaways.

- Not reviewing the budget: Life changes, so should your budget.

- Ignoring children’s expenses: School trips, uniforms, activities can add up quickly.

- Failing to communicate: A budget only works if everyone in the household follows it.

Real-Life Examples of Using a Household Budget Calculator

- Family with young children: Tracks childcare costs and reallocates savings into an education fund.

- Couple saving for a home: Uses the calculator to cut entertainment spending and boost deposit savings.

- Single-parent household: Balances limited income with essentials while ensuring an emergency buffer.

These examples show how the tool adapts to different family situations.

FAQs: Personal Finance & Household Budgeting

Q1: How often should a family update their budget?

At least once a month, or whenever income or expenses change.

Q2: Can a household budget calculator help reduce debt?

Yes—it shows how much extra can be allocated to debt repayments each month.

Q3: Should kids be involved in budgeting?

Yes, in simple ways. It teaches them money values early.

Q4: What if our expenses are higher than our income?

Identify areas to cut back, and consider extra income streams like part-time work.

Q5: Is budgeting only for low-income families?

No. High-income families also benefit by aligning money with long-term goals.

Conclusion: Take Control of Family Finances

Personal finance isn’t about how much money you make—it’s about how you manage it. A household budget calculator gives families the clarity and structure they need to spend wisely, save more, and prepare for the future.

By tracking income, planning expenses, and setting goals, families can avoid financial stress and work together toward true financial freedom.

💡 Ready to simplify your family’s money management? Try our Household Budget Calculator today and start making smarter financial choices.